View All

Reno County Appraiser explains required RNR notices recently mailed to property owners

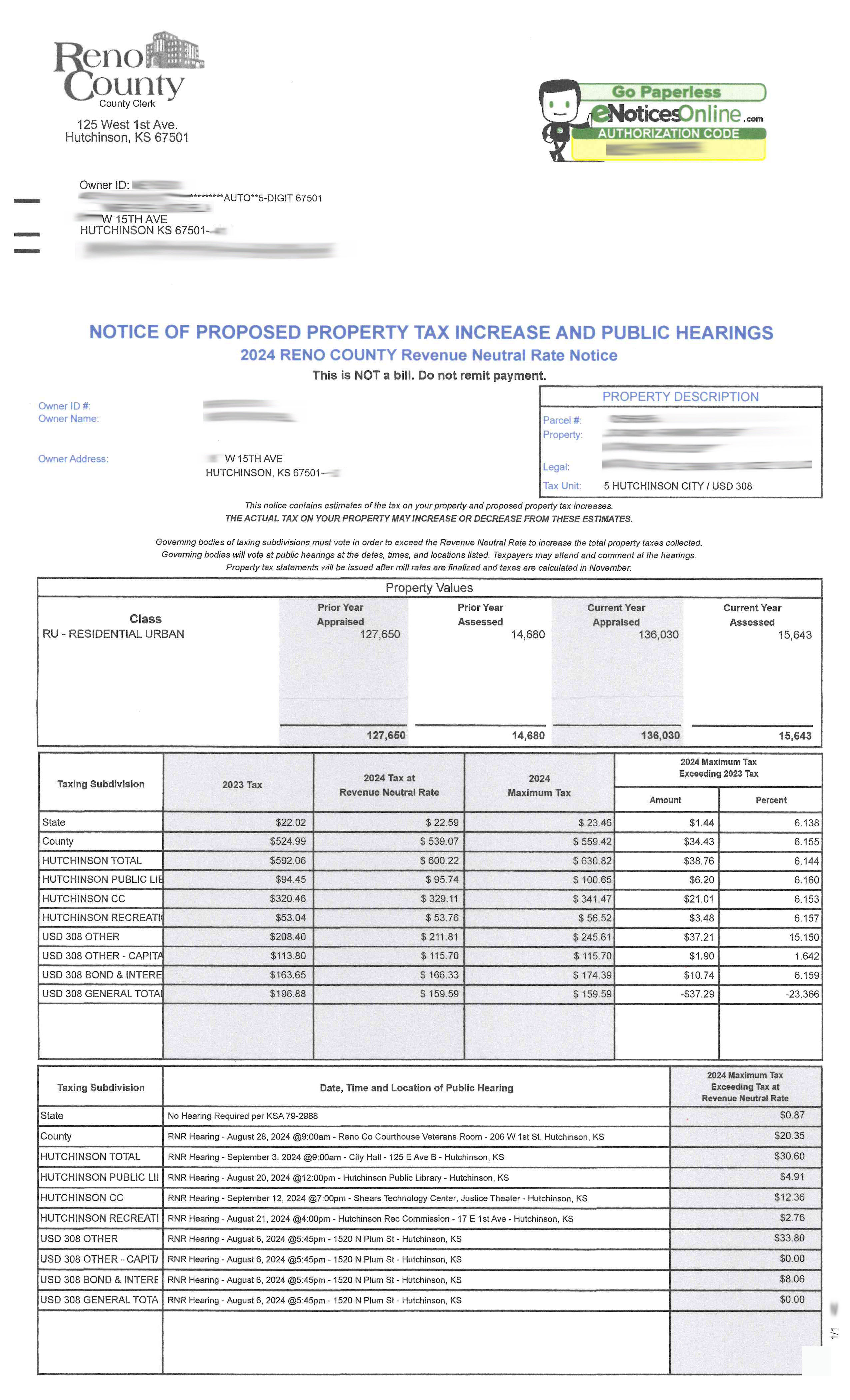

You should have recently received an interesting – and perhaps hard to understand – notice in the mail from Reno County earlier this week. Pursuant to K.S.A. 79-2988, the county has mailed the required Revenue Neutral Rate (RNR) Notice to all property owners.

The law requires counties to send taxpayers a notification of the revenue neutral rate compared to the proposed tax rates for each taxing entity that has expressed its intent to exceed its revenue neutral rate.

The mailing you received is simply a notification; it is not a tax bill, and you are not being asked or required to pay anything. This is also not a new or updated valuation notice, so you cannot appeal your valuation at this time. It is simply for informal purposes only, to notify taxpayers of public hearings that could affect their property taxes. This notice provides the dates, times, and locations for public hearings to be held by each taxing authority intending to exceed their revenue neutral rate.

Your total property tax bill is determined by the yearly budgets set by the various taxing entities that have jurisdiction in your area. These entities can include (but may not be limited to): city, county, school district, community college, library, township, other improvement districts such as a recreation commission, or fire district. So, if one entity increases its budget by 10%, that does not necessarily mean that your property taxes will increase by 10%, because that entity is just one portion of your total property tax bill.

The revenue neutral rate is the mill levy required to generate the exact same amount of property tax dollars next year as the year before, but using the current year's total assessed valuation. For example: If a taxing entity collected $1,000,000 of property tax revenue in the current year, being revenue neutral means they plan to only collect $1,000,000 in the next year as well. But if a taxing jurisdiction plans to collect more property tax dollars in the next budget year compared to the current year, even if it’s just $1 more, they would exceed revenue neutral and are therefore required by law to hold a public hearing.

This notice and its contents were crafted by the Kansas Legislature to promote transparency in government. If you have questions or comments about the legislation requiring the notice, you should contact your state representative and/or state senator directly. If you have questions about the budget hearings, you should contact the appropriate taxing entity directly, or reach out to the Reno County Clerk’s office. If you have questions about the valuation or assessed value, you should reach out to the Reno County Appraiser’s office. If you have questions about the Reno County budget, contact the Reno County Administrator.

Find your legislator: www.kslegislature.org

Reno County Clerk: 620-694-2934

Reno County Appraiser: 620-694-2915

Reno County Administration: 620-694-2929

A Notification Example: